Kenya is doing well in the mobile money sector, thanks to Safaricom’s mobile wallet MPesa that has garnered much praise and popularity across nations around the world. Through partnerships, Kenyans in the diaspora can now send money directly to their family and friends to their MPesa wallets.

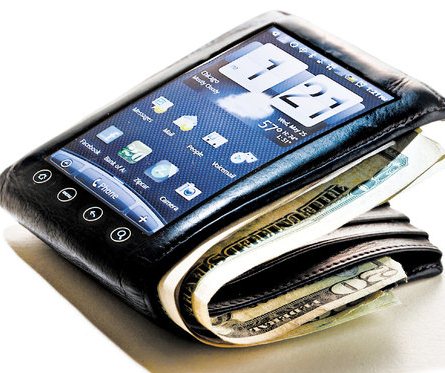

We are at a digital age where everything is being done on-the-go and businesses are being run on the Cloud, with the only requirement being a mobile device. The age is also looking forward to end cash payments in business operations by advocating for cashless payments across different sectors.

The transport sector is gearing to incorporate cashless card systems in fare payments by pedestrians, with some matatu operators already having set February 1st as the deadline to accept fare in form of cash. The government is also working to automate all its services so people can make payments for their services without having to carry cash.

Following this move by different sectors to incorporate mobile payments, Kenyans can now pay for their electricity bills electronically by purchasing tokens using mobile money, paying for water bills, paying taxes and now recently paying for parking slots in Nairobi CBD and its environs.

That being said about paying for services, there is the need to purchase goods from stores and product outlets. Most people have adopted the mobile wallet technology, which is of course a very endearing move as it makes it easy to do shopping and eliminates the long lines in traditional cash payments.

Online shopping sites are not the issue here, as these mostly use mobile wallets for their payments. It would not make sense to sell products online and go collecting cash from clients, unless a company insists on cash payments on delivery – I don’t see why anyone would subject themselves to this hustle.

Going back to the advantage of MPesa, supermarkets and other stores across the country have adopted the mobile money platform in their outlets to allow customers pay for their shopping directly from their MPesa. Paying for drinks in a club or food in a restaurant is also being done through mobile money – cool indeed.

This trend, however, is still yet to be adopted by some organisations and shopping stores who still insist that people should make payments with cash. So why are some merchants still shying away to the latest and most effective trend of business transactions?

Is it that they are not sensitized enough about the benefits of adopting a mobile wallet strategy? Or is it that they are yet to find a mobile money platform they can trust enough to incorporate in their business? Maybe it’s the two, or maybe it’s just ignorance but either way all merchants should consider mobile payments a necessity.

Taking up a mobile wallet plan guarantees a merchant various benefits that include, but not limited to increased security as the mobile payment method stays with the customer, customer satisfaction with elimination of lines as well as reduce cash in hand, which helps secure the business against losses.

Use of mobile wallets has also been reported to grow revenue in businesses and reduce the operating costs that may come about as a result of loss through fraud or the payment processing fees that are incurred in other payment plans.

Mobile has revolutionized commerce with a never-seen-before way of doing business, becoming the most disruptive force in the sector. It will also be the platform through which companies will connect with consumers for better customer experience, like it is being witnessed with the new mobile apps.

With this kind of mobile world and the advancements in the sector that are yet to come, it is vital for merchants of all kinds to adopt a mobile wallet plan for its transactions in order to cater for customers wherever they are and at any time. It is the existing customer demand that merchants must meet to increase productivity.